Let’s be real—getting into crypto feels a bit like showing up at a party where everyone’s speaking a language you kind of understand, but not really. I still remember the day I bought my first crypto on Binance and thought, “Nice, it’s in my wallet now.” Except… it wasn’t. It was sitting on an exchange, completely unprotected. Classic rookie moves.

That’s exactly why this question matters: Crypto Wallet vs Crypto Exchange: What’s the Real Difference & Which One Should You Use?

If you’ve ever asked yourself that—or even mixed the two up—you’re definitely not alone. But honestly, knowing the difference early can save you a ton of confusion, stress, and yeah… maybe even some money.

Let’s break it all down—no jargon, no fluff. Just real talk.

Understanding the Basics of Cryptocurrency Storage:

What Is a Cryptocurrency Exchange?

Think of an exchange as your on-ramp to crypto. It’s where you buy, sell, or trade coins. Kind of like a stock trading app, but for Bitcoin, Ethereum, and that meme coin your friend won’t shut up about. Big platforms like Binance, Coin. DCX, and Coinbase are considered centralized exchanges (CEX), while Uniswap or Pancake Swap are decentralized (DEX).

But here’s the kicker: when you buy crypto on an exchange, you don’t actually hold the keys to it. You have access, but not ownership. It’s like renting a locker at the gym you use it, but you don’t have the master key.

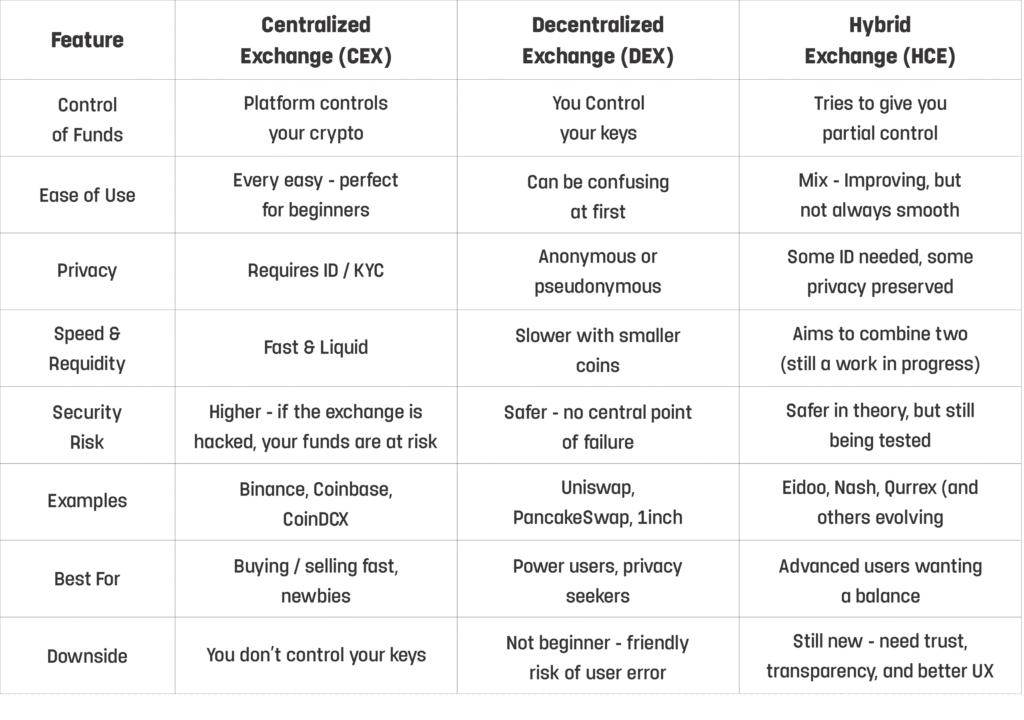

Types of Cryptocurrency Exchanges:

Not all crypto exchanges are created equal and no, you don’t have to know them all by heart, but understanding the basic categories can help you pick the right one without accidentally trusting the wrong one (been there).

Centralized Exchanges (CEX) These are run by companies. You sign up, verify your ID, and the platform handles everything from matching buyers and sellers to holding your funds (temporarily). Think Binance, Coinbase, Coin. DCX.

- Easy to use

- You don’t control your private keys

- Decentralized Exchanges (DEX) These are peer-to-peer platforms that run on smart contracts. No middlemen, no account signup. You just connect your wallet and trade. Think Uniswap, Pancake Swap, 1inch.

- More privacy, more control

- Slightly more technical (and no “forgot password” support)

- Hybrid Exchanges Still evolving, these platforms try to offer the best of both worlds: the speed and liquidity of centralized exchanges with the privacy and security of decentralized ones.

- Promising but less common

- Trust layer still being tested

If you’re new, CEXs are probably your first stop. Just remember: they’re convenient—but not always the safest place to store your coins long-term.

What Is a Cryptocurrency Wallet?

A crypto wallet is where the real magic happens. It’s not just a digital pocket it stores your private keys, which give you actual ownership of your coins. If you own the keys, you own the crypto. Period.

There are hot wallets (online, easier access) and cold wallets (offline, way safer). Hot wallets like Meta. Mask are great for everyday use, while cold wallets like Ledger or Trezor are perfect for long-term storage.

Bottom line: wallets = freedom, but also responsibility.

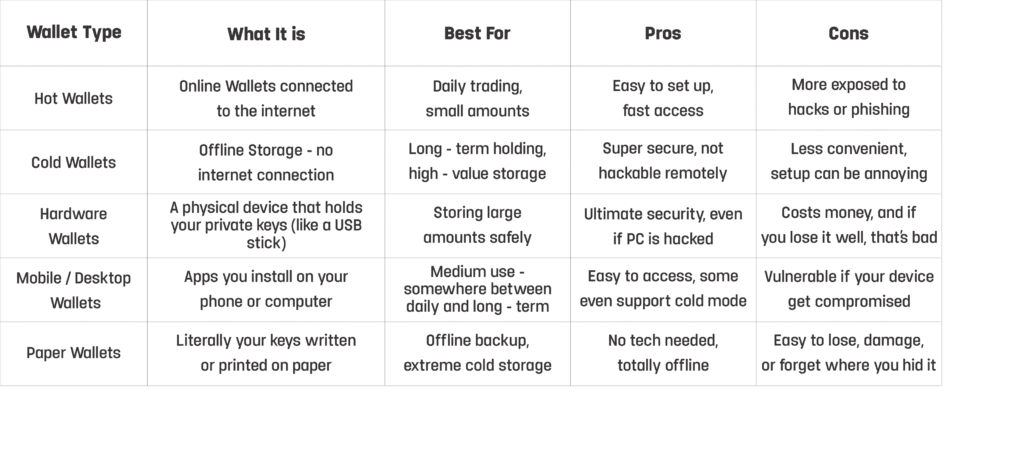

Types of Cryptocurrency Wallets

Wallets are like shoes there’s no one-size-fits-all. It depends on what you’re doing and how much you’re holding.

Here’s a human-friendly rundown of the main types:

Hot Wallets These are connected to the internet and great for quick access. Think Meta. Mask, Trust Wallet, Phantom (for Solana).

- Convenient for daily use

- More exposed to online threats

Cold Wallets These stay offline. Usually, physical devices like a USB or air-gapped computer. Think Ledger, Trezor.

- Super secure

- Less convenient for frequent transactions

Hardware Wallets This is a type of cold wallet that stores your keys in a physical device. Even if your computer gets hacked, your crypto stays safe.

- Perfect for long-term HODLERS

- Costs money (~$50–$200)

Mobile/Desktop Wallets Apps on your phone or computer. Some are hot, some let you toggle into cold storage mode.

- Good balance of access + control

- Vulnerable if your device is compromised

Paper Wallets Old-school but still used: your private and public keys printed on paper.

- No tech vulnerabilities

- Easy to lose, burn, or damage

Most smart users combine a hot wallet for spending and a cold wallet for saving. It’s not about being paranoid it’s about being prepared.

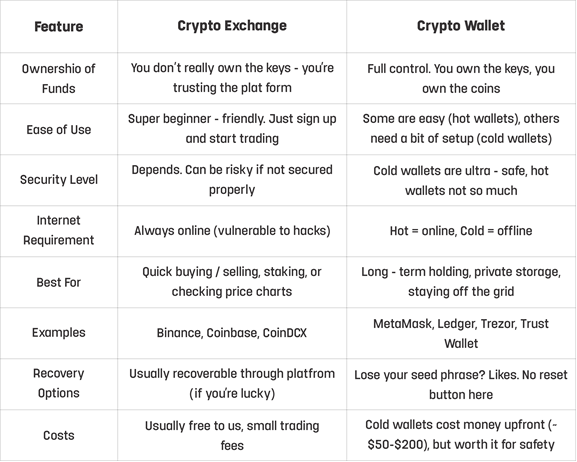

Crypto Wallet vs Exchange: What’s the Real Difference?

It comes down to ownership and control.

- Exchange: You can access your coins, but you don’t own them.

- Wallet: You own your coins—if you keep your keys safe.

So yeah, pretty big deal.

Control and Ownership of Private Keys

Exchanges hold your keys for you. It’s like trusting a bank to watch your money… except it’s not even a real bank. If the exchange gets hacked or shuts down? Your funds are at risk.

Wallets, on the other hand, give you full control. But that also means you’re responsible if something goes wrong. Lose your seed phrase? You’re locked out—forever.

Internet Connectivity and Security Levels

Exchanges are always online, which means they’re always vulnerable. Convenient, sure but risky.

Wallets come in two flavors:

- Hot wallets = connected, convenient, slightly risky.

- Cold wallets = offline, safe, but slightly less convenient.

If you’re serious about protecting your crypto, cold storage is the way to go.

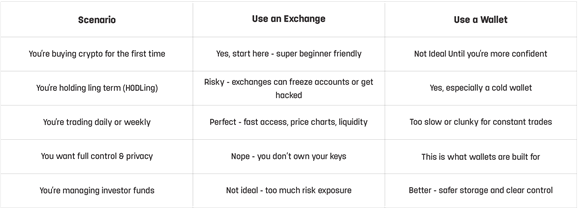

Which One Should You Use Crypto Wallet or Crypto Exchange:

If you’re just exploring crypto? Start with an exchange—learn the ropes.

But if you’re holding long-term or managing investor capital (like we do at Key Konnect), you’ll want to transfer your assets to a wallet, especially a cold wallet for maximum safety. It’s a bit more work—but 100% worth it.

Use Cases: When to Use a Crypto Wallet vs crypto Exchange :

Ideal Scenarios for Cryptocurrency Exchanges

- Buying or selling quickly

- Trading actively

- Checking portfolio performance

- Earning passive income through staking or lending

Just don’t forget—exchanges are for action, not for long-term storage.

Best Situations for Cryptocurrency Wallets

- Holding long-term (aka Hodling)

- Keeping your funds truly private and in your control

- Safeguarding assets offline (especially large amounts)

- Protecting your coins from political instability or internet outages

Security Considerations for Both Options:

Common Risks with Cryptocurrency Exchanges

- Hacks (yes, even the big ones)

- Freezing or blocking withdrawals

- Platform shutdowns or legal drama

- Phishing, SIM swaps, and fake websites

If you’re gonna use exchanges, enable 2FA and whitelist your withdrawal addresses at the very least.

Security Tips for Managing Your Wallet Safely

- Store your recovery phrase offline—never in cloud storage

- Use cold wallets for large amounts

- Avoid clicking suspicious links (always double-check URLs)

- Keep backups. Test them. Treat your wallet like gold.

Owning your crypto also means owning your mistakes—so double-check everything.

Real-World Examples: User Experiences and Mistakes:

I Left My Crypto on an Exchange—Here’s What Happened

I once left ETH on an exchange. One day, I logged in and got hit with an account freeze. Took three weeks of email ping-pong to get back in. By then? ETH had tanked. Would’ve cried if I hadn’t already learned that lesson the hard way.

Lesson: exchanges are temporary homes, not vaults.

How My Wallet Saved Me from a Costly Error

Once, I used a hot wallet to dabble in a shady token. The token rug-pulled. Luckily, I’d only sent a small portion of ETH from my cold wallet. The rest was untouched.

Lesson: use multiple wallets and compartmentalize your funds. It could save you one day.

Conclusion and Actionable Tips:

Key Takeaways for New Crypto Users

- Exchanges = great for activity, not for storage

- Wallets = real ownership, but come with real responsibility

- Never share your seed phrase. Ever.

- Cold wallets are worth the setup hassle

- Mistakes in crypto are very expensive. Learn from others.

Making the Right Choice for Your Crypto Journey

There’s no one-size-fits-all. If you’re new? Start with an exchange but move your funds to a wallet as soon as you can. If you’re serious? Get a cold wallet.

Whatever you do, stay curious, stay cautious, and keep learning. Because in crypto, the moment you think you’ve got it all figured out… something surprises you.

Want to learn how cryptocurrency stays secure behind the scenes?

Discover the two key features that help protect your crypto assets from fraud and hacks.

Read the full article here.

FAQ:

Q1) Should I hold my crypto in a wallet or just leave it on the exchange?

If you’re holding long-term (Hodling), a cold wallet like Ledger or Trezor is your safest bet. Exchanges are fine for short-term trading or staking, but they’re always online and vulnerable. Wallets, especially offline ones, give you full control—and no one can freeze your account. Just don’t lose your seed phrase!

Q2) What’s the difference between a hot wallet and a cold wallet?

Hot wallets are online (like MetaMask or Trust Wallet)—great for fast access. Cold wallets stay offline (like Ledger)—way safer, but slower to use.

Q3) What’s the actual difference between a wallet and an exchange? Isn’t it the same thing?

Nope, not the same. An exchange is like a crypto marketplace—you buy, sell, trade there. But a wallet is where you actually store your crypto, especially if you’re serious about security. When your crypto is on an exchange, you don’t own the keys. In a wallet, you do. Big difference.

Q4) What wallet type should I use if I’m a beginner but want to play it safe?

Start with a hot wallet like Trust Wallet or MetaMask—super easy to set up, no hardware needed. Once you’re more comfortable, consider getting a hardware wallet like Ledger Nano S. It takes a bit of learning, but if you’re holding large amounts or managing other people’s funds, it’s the safest option out there.

Q5) What if I lose access to my wallet? Can I get my crypto back?

If you lose your recovery phrase (aka seed phrase) and didn’t back it up… unfortunately, your crypto is gone forever. There’s no reset button. That’s the trade-off with wallets—you get full control, but also full responsibility. Pro tip: store your phrase offline, maybe even in multiple locations.

Q6) Is a hardware wallet the same as a cold wallet?

Pretty much! All hardware wallets are cold wallets, but not all cold wallets are hardware. Think: hardware = USB device, cold = anything offline.

Q7) Are hybrid exchanges better than regular ones? Should I switch?

Hybrid exchanges like Eidoo or Nash try to combine the best of both worlds—CEX speed with DEX privacy and control. Cool concept, but still evolving. They’re not bad if you’re experienced and want to explore beyond the basics. But for beginners, sticking to a CEX + Wallet combo is usually simpler (and safer, for now).

Q8) What’s the difference between a centralized and decentralized exchange?

Centralized exchanges (like or Coinbase) are easy to use but hold your keys. Decentralized ones (like Uniswap) let you control everything—but they’re a bit techier.

Q9) Are hybrid exchanges safe to use?

They’re promising, but still kind of “in beta.” Hybrid exchanges try to mix CEX convenience with DEX privacy. Cool idea—but not all of them are fully polished yet.

Q10) Which exchange is best for beginners?

CEXs like Binance, Coinbase, or CoinDCX are beginner-friendly. You just sign up, verify ID, and you’re good to go. No wallet setup stress (at least not at first).